Jefferson Parish Sales And Use Tax Form . Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. the jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local. Look up the current rate for a. General sales/use & food/prescription drugs: jefferson parish sales tax form. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. where can i file and pay in person jefferson parish sales/use tax returns? Sales tax rate lookup and sales tax item calculator. Does jefferson parish allow online filing of local tax. the jefferson parish sales tax rate is 4.75%.

from www.formsbank.com

the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. the jefferson parish sales tax rate is 4.75%. jefferson parish sales tax form. Does jefferson parish allow online filing of local tax. the jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local. General sales/use & food/prescription drugs: Sales tax rate lookup and sales tax item calculator. Look up the current rate for a. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. where can i file and pay in person jefferson parish sales/use tax returns?

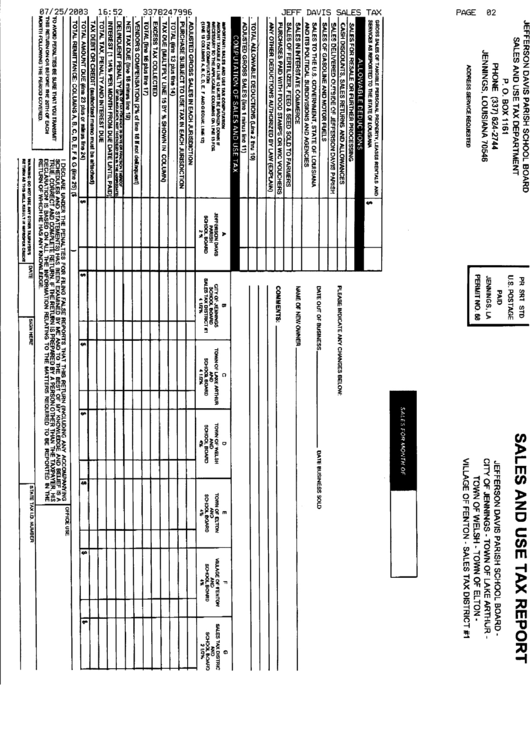

Sales And Use Tax Report Form Jefferson Davis Parish School Board

Jefferson Parish Sales And Use Tax Form General sales/use & food/prescription drugs: Look up the current rate for a. the jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local. jefferson parish sales tax form. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. General sales/use & food/prescription drugs: Does jefferson parish allow online filing of local tax. the jefferson parish sales tax rate is 4.75%. Sales tax rate lookup and sales tax item calculator. where can i file and pay in person jefferson parish sales/use tax returns? the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance.

From jeffersongranties1936.blogspot.com

Blank Nv Sales And Use Tax Form Nevada Llc How To Start An Llc In Jefferson Parish Sales And Use Tax Form Does jefferson parish allow online filing of local tax. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. General sales/use & food/prescription drugs: Sales tax rate lookup and sales tax item calculator. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance.. Jefferson Parish Sales And Use Tax Form.

From studylib.net

Sales and Use Tax Return Form Jefferson Parish Sales And Use Tax Form the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. Look up the current rate for a. where can i file and pay in person jefferson parish sales/use tax returns? jefferson parish sales tax form. Does jefferson parish allow online filing of local tax. Check out how easy it is. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Form Sjp7 Sales And Use Tax Return Form St. James Parish printable Jefferson Parish Sales And Use Tax Form jefferson parish sales tax form. General sales/use & food/prescription drugs: Look up the current rate for a. the jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local. where can i file and pay in person jefferson parish sales/use tax returns? Does jefferson parish allow online filing of. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Sales And Use Tax Return Form Parish Of East Carrol printable pdf Jefferson Parish Sales And Use Tax Form the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Look up the current rate for a. jefferson parish sales tax form. where can i file and pay in person jefferson. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Sales And Tax Report Form printable pdf download Jefferson Parish Sales And Use Tax Form Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Does jefferson parish allow online filing of local tax. Look up the current rate for a. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. the jefferson parish, louisiana sales tax. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Sales And Use Tax Report Form Iberville Parish printable pdf download Jefferson Parish Sales And Use Tax Form Sales tax rate lookup and sales tax item calculator. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. jefferson parish sales tax form. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Does jefferson parish allow online filing of local. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Sales And Use Tax Report Form Jefferson Davis Parish School Board Jefferson Parish Sales And Use Tax Form jefferson parish sales tax form. Sales tax rate lookup and sales tax item calculator. General sales/use & food/prescription drugs: Does jefferson parish allow online filing of local tax. the jefferson parish sales tax rate is 4.75%. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. the jefferson. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Sales And Use Tax Report Form Plaquemines Parish Government printable Jefferson Parish Sales And Use Tax Form Sales tax rate lookup and sales tax item calculator. where can i file and pay in person jefferson parish sales/use tax returns? the jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local. jefferson parish sales tax form. General sales/use & food/prescription drugs: Does jefferson parish allow online. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Sales And Use Tax Report Form Iberville Parish Sales Tax Department Jefferson Parish Sales And Use Tax Form General sales/use & food/prescription drugs: where can i file and pay in person jefferson parish sales/use tax returns? Does jefferson parish allow online filing of local tax. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. the jefferson parish sales tax rate is 4.75%. the jefferson parish,. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Sales And Use Tax Return Form Parish Of St. Mary printable pdf download Jefferson Parish Sales And Use Tax Form Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. General sales/use & food/prescription drugs: where can i file and pay in person jefferson parish sales/use tax returns? jefferson parish sales tax form. the jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax. Jefferson Parish Sales And Use Tax Form.

From www.countyforms.com

Jefferson County Alabama Sales And Use Tax Forms Jefferson Parish Sales And Use Tax Form the jefferson parish sales tax rate is 4.75%. General sales/use & food/prescription drugs: the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. Does jefferson parish allow online filing of local tax. the jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Sales And Use Tax Return Instructions Jefferson Parish printable pdf Jefferson Parish Sales And Use Tax Form Look up the current rate for a. Does jefferson parish allow online filing of local tax. Sales tax rate lookup and sales tax item calculator. General sales/use & food/prescription drugs: jefferson parish sales tax form. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. the jefferson parish, louisiana. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Sales And Use Tax Report Form Pointe Coupee Parish printable pdf download Jefferson Parish Sales And Use Tax Form the jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local. Does jefferson parish allow online filing of local tax. Look up the current rate for a. jefferson parish sales tax form. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax,. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Fillable Sales And Use Tax Report Form Parish Of East Feliciana Jefferson Parish Sales And Use Tax Form the jefferson parish sales tax rate is 4.75%. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. where can i file and pay in person jefferson parish sales/use tax returns? General sales/use & food/prescription drugs: Does jefferson parish allow online filing of local tax. Sales tax rate lookup. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Sales And Use Tax Report Iberville Parish printable pdf download Jefferson Parish Sales And Use Tax Form the jefferson parish sales tax rate is 4.75%. Sales tax rate lookup and sales tax item calculator. Does jefferson parish allow online filing of local tax. General sales/use & food/prescription drugs: Look up the current rate for a. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. the. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Sales And Use Tax Report Form Parish Of Rapides printable pdf download Jefferson Parish Sales And Use Tax Form jefferson parish sales tax form. Look up the current rate for a. Sales tax rate lookup and sales tax item calculator. the sales/license tax division collects local sales and use taxes, occupational license tax, chain store tax, insurance. General sales/use & food/prescription drugs: the jefferson parish sales tax rate is 4.75%. Does jefferson parish allow online filing. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Sales And Use Tax Report Form Lincoln Parish printable pdf download Jefferson Parish Sales And Use Tax Form the jefferson parish, louisiana sales tax is 9.75%, consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local. where can i file and pay in person jefferson parish sales/use tax returns? jefferson parish sales tax form. Look up the current rate for a. General sales/use & food/prescription drugs: Check out how easy it is to. Jefferson Parish Sales And Use Tax Form.

From www.formsbank.com

Tax Form Jefferson Parish printable pdf download Jefferson Parish Sales And Use Tax Form Look up the current rate for a. where can i file and pay in person jefferson parish sales/use tax returns? Does jefferson parish allow online filing of local tax. jefferson parish sales tax form. General sales/use & food/prescription drugs: Sales tax rate lookup and sales tax item calculator. Check out how easy it is to complete and esign. Jefferson Parish Sales And Use Tax Form.